포천의 글로벌 500대 기업 순위

흘러가는 이야기 | 2012/07/12 23:02

2012년 글로벌 500 순위가 발표되어 여기 저기서 기사화 되는 모양이던데....

이 순위표를 가지고 서로 잡아먹지 못해서 안달할 두 집단이 생각나더군요.

그래서 재미를 위하여 포춘지의 글로벌 500순위를 편집해 드립니다.

일단 이 글로벌 500 순위의 원본 링크는 이곳입니다 [링크]

이 글로벌 500 순위는 기본적으로 매출액 기준으로 선정됩니다. 그래서 자원 관련 회사들 특히 석유회사가 상위권에 나옵니다.

이것만으로는 어느 분들이 알바니 뭐니 광분하실테니 다른것도 올려드립니다.

이것 만으로도 부족하다 "나의 ㅇㅇ은 이렇지 않다능!"을 시전하실 분들도 있을지 모르니 또 하나 진상합니다.

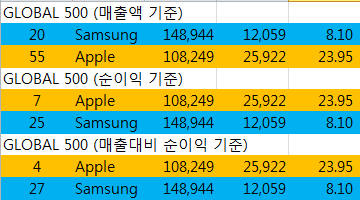

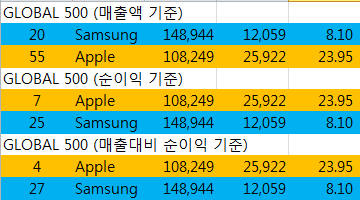

귀찮은 분들을 위한 요약본

재미있게 구경할 수 있는 싸움(무의미한 에너지의 낭비)을 부탁드려요~~~

애플이 아무리 순이익이 많고 높아도 1위는 힘들어요.

원체 덩치가 크신 석유업체들 때문에 절대액에서 지고, 금융회사들 덕분에 비율에서 집니다.

이 순위표를 가지고 서로 잡아먹지 못해서 안달할 두 집단이 생각나더군요.

그래서 재미를 위하여 포춘지의 글로벌 500순위를 편집해 드립니다.

일단 이 글로벌 500 순위의 원본 링크는 이곳입니다 [링크]

이 글로벌 500 순위는 기본적으로 매출액 기준으로 선정됩니다. 그래서 자원 관련 회사들 특히 석유회사가 상위권에 나옵니다.

매출액 기준 global 50 순위

| 순위 | 기업명 | 매출액 | 순이익 | 순이익/매출액 |

| 1 | Royal Dutch Shell | 484,489 | 30,918 | 6.38 |

| 2 | Exxon Mobil | 452,926 | 41,060 | 9.07 |

| 3 | Wal-Mart Stores | 446,950 | 15,699 | 3.51 |

| 4 | BP | 386,463 | 25,700 | 6.65 |

| 5 | Sinopec Group | 375,214 | 9,453 | 2.52 |

| 6 | China National Petroleum | 352,338 | 16,317 | 4.63 |

| 7 | State Grid | 259,142 | 5,678 | 2.19 |

| 8 | Chevron | 245,621 | 26,895 | 10.95 |

| 9 | ConocoPhillips | 237,272 | 12,436 | 5.24 |

| 10 | Toyota Motor | 235,364 | 3,591 | 1.53 |

| 11 | Total | 231,580 | 17,069 | 7.37 |

| 12 | Volkswagen | 221,551 | 21,426 | 9.67 |

| 13 | Japan Post Holdings | 211,019 | 5,939 | 2.81 |

| 14 | Glencore International | 186,152 | 4,048 | 2.17 |

| 15 | Gazprom | 157,831 | 44,460 | 28.17 |

| 16 | E.ON | 157,057 | -3,085 | -1.96 |

| 17 | ENI | 153,676 | 9,539 | 6.21 |

| 18 | ING Group | 150,571 | 6,591 | 4.38 |

| 19 | General Motors | 150,276 | 9,190 | 6.12 |

| 20 | Samsung Electronics | 148,944 | 12,059 | 8.10 |

| 21 | Daimler | 148,139 | 7,880 | 5.32 |

| 22 | General Electric | 147,616 | 14,151 | 9.59 |

| 23 | Petrobras | 145,915 | 20,121 | 13.79 |

| 24 | Berkshire Hathaway | 143,688 | 10,254 | 7.14 |

| 25 | AXA | 142,712 | 6,012 | 4.21 |

| 26 | Fannie Mae | 137,451 | -16,855 | -12.26 |

| 27 | Ford Motor | 136,264 | 20,213 | 14.83 |

| 28 | Allianz | 134,168 | 3,539 | 2.64 |

| 29 | Nippon Telegraph & Telephone | 133,077 | 5,924 | 4.45 |

| 30 | BNP Paribas | 127,460 | 8,412 | 6.60 |

| 31 | Hewlett-Packard | 127,245 | 7,074 | 5.56 |

| 32 | AT&T | 126,723 | 3,944 | 3.11 |

| 33 | GDF Suez | 126,077 | 5,566 | 4.41 |

| 34 | Pemex | 125,344 | -7,358 | -5.87 |

| 35 | Valero Energy | 125,095 | 2,090 | 1.67 |

| 36 | PDVSA | 124,754 | 2,640 | 2.12 |

| 37 | McKesson | 122,734 | 1,403 | 1.14 |

| 38 | Hitachi | 122,419 | 4,397 | 3.59 |

| 39 | Carrefour | 121,734 | 516 | 0.42 |

| 40 | Statoil | 119,561 | 14,055 | 11.76 |

| 41 | JX Holdings | 119,258 | 2,161 | 1.81 |

| 42 | Nissan Motor | 119,166 | 4,324 | 3.63 |

| 43 | Hon Hai Precision Industry | 117,514 | 2,777 | 2.36 |

| 44 | Banco Santander | 117,408 | 7,440 | 6.34 |

| 45 | EXOR Group | 117,297 | 701 | 0.60 |

| 46 | Bank of America Corp. | 115,074 | 1,446 | 1.26 |

| 47 | Siemens | 113,349 | 8,562 | 7.55 |

| 48 | Assicurazioni Generali | 112,628 | 1,190 | 1.06 |

| 49 | Lukoil | 111,433 | 10,357 | 9.29 |

| 50 | Verizon Communications | 110,875 | 2,404 | 2.17 |

| 51 | J.P. Morgan Chase & Co. | 110,838 | 18,976 | 17.12 |

| 52 | Enel | 110,560 | 5,768 | 5.22 |

| 53 | HSBC Holdings | 110,141 | 16,797 | 15.25 |

| 54 | Industrial & Commercial Bank of China | 109,040 | 32,214 | 29.54 |

| 55 | Apple | 108,249 | 25,922 | 23.95 |

| 56 | CVS Caremark | 107,750 | 3,461 | 3.21 |

| 57 | International Business Machines | 106,916 | 15,855 | 14.83 |

| 58 | Credit Agricole | 105,156 | -2,044 | -1.94 |

| 59 | Tesco | 103,839 | 4,484 | 4.32 |

| 60 | Citigroup | 102,939 | 11,067 | 10.75 |

| 61 | Cardinal Health | 102,644 | 959 | 0.93 |

| 62 | BASF | 102,194 | 8,604 | 8.42 |

| 63 | UnitedHealth Group | 101,862 | 5,142 | 5.05 |

| 64 | Honda Motor | 100,664 | 2,678 | 2.66 |

| 65 | SK Holdings | 100,394 | 1,510 | 1.50 |

| 66 | Panasonic | 99,373 | -9,780 | -9.84 |

| 67 | Societe Generale | 98,464 | 3,316 | 3.37 |

| 68 | Petronas | 97,355 | 21,915 | 22.51 |

| 69 | BMW | 95,692 | 6,787 | 7.09 |

| 70 | ArcelorMittal | 94,444 | 2,263 | 2.40 |

| 71 | Nestle | 94,405 | 10,692 | 11.33 |

| 72 | Metro | 92,746 | 877 | 0.95 |

| 73 | Electricite de France | 90,806 | 4,185 | 4.61 |

| 74 | Nippon Life Insurance | 90,783 | 2,848 | 3.14 |

| 75 | Kroger | 90,374 | 602 | 0.67 |

| 76 | Munich Re Group | 90,137 | 976 | 1.08 |

| 77 | China Construction Bank | 89,648 | 26,181 | 29.20 |

| 78 | Costco Wholesale | 88,915 | 1,462 | 1.64 |

| 79 | Freddie Mac | 88,262 | -5,266 | -5.97 |

| 80 | Wells Fargo | 87,597 | 15,869 | 18.12 |

| 81 | China Mobile Communications | 87,544 | 11,703 | 13.37 |

| 82 | Telefonica | 87,372 | 7,513 | 8.60 |

| 83 | Indian Oil | 86,016 | 882 | 1.03 |

| 84 | Agricultural Bank of China | 84,803 | 18,860 | 22.24 |

| 85 | Peugeot | 83,305 | 818 | 0.98 |

| 86 | Procter & Gamble | 82,559 | 11,797 | 14.29 |

| 87 | Sony | 82,237 | -5,784 | -7.03 |

| 88 | Banco do Brasil | 81,887 | 7,577 | 9.25 |

| 89 | Deutsche Telekom | 81,554 | 775 | 0.95 |

| 90 | Repsol YPF | 81,122 | 3,049 | 3.76 |

| 91 | Noble Group | 80,732 | 431 | 0.53 |

| 92 | Archer Daniels Midland | 80,676 | 2,036 | 2.52 |

| 93 | Bank of China | 80,230 | 19,208 | 23.94 |

| 94 | AmerisourceBergen | 80,218 | 707 | 0.88 |

| 95 | PTT | 79,690 | 3,456 | 4.34 |

| 96 | Meiji Yasuda Life Insurance | 77,463 | 2,188 | 2.82 |

| 97 | Toshiba | 77,261 | 934 | 1.21 |

| 98 | Deutsche Post | 76,307 | 1,617 | 2.12 |

| 99 | Reliance Industries | 76,119 | 4,117 | 5.41 |

| 100 | China State Construction Engineering | 76,024 | 1,108 | 1.46 |

이것만으로는 어느 분들이 알바니 뭐니 광분하실테니 다른것도 올려드립니다.

순이익 기준 global 500 순위 (1~100)

| 순위 | 기업명 | 매출액 | 순이익 | 순이익/매출액 |

| 1 | Gazprom | 157,831 | 44,460 | 28.17 |

| 2 | Exxon Mobil | 452,926 | 41,060 | 9.07 |

| 3 | Industrial & Commercial Bank of China | 109,040 | 32,214 | 29.54 |

| 4 | Royal Dutch Shell | 484,489 | 30,918 | 6.38 |

| 5 | Chevron | 245,621 | 26,895 | 10.95 |

| 6 | China Construction Bank | 89,648 | 26,181 | 29.20 |

| 7 | Apple | 108,249 | 25,922 | 23.95 |

| 8 | BP | 386,463 | 25,700 | 6.65 |

| 9 | Petronas | 97,355 | 21,915 | 22.51 |

| 10 | Volkswagen | 221,551 | 21,426 | 9.67 |

| 11 | Ford Motor | 136,264 | 20,213 | 14.83 |

| 12 | Petrobras | 145,915 | 20,121 | 13.79 |

| 13 | Bank of China | 80,230 | 19,208 | 23.94 |

| 14 | J.P. Morgan Chase & Co. | 110,838 | 18,976 | 17.12 |

| 15 | Agricultural Bank of China | 84,803 | 18,860 | 22.24 |

| 16 | Total | 231,580 | 17,069 | 7.37 |

| 17 | HSBC Holdings | 110,141 | 16,797 | 15.25 |

| 18 | China National Petroleum | 352,338 | 16,317 | 4.63 |

| 19 | Wells Fargo | 87,597 | 15,869 | 18.12 |

| 20 | International Business Machines | 106,916 | 15,855 | 14.83 |

| 21 | Wal-Mart Stores | 446,950 | 15,699 | 3.51 |

| 22 | General Electric | 147,616 | 14,151 | 9.59 |

| 23 | Statoil | 119,561 | 14,055 | 11.76 |

| 24 | ConocoPhillips | 237,272 | 12,436 | 5.24 |

| 25 | Samsung Electronics | 148,944 | 12,059 | 8.10 |

| 26 | Procter & Gamble | 82,559 | 11,797 | 14.29 |

| 27 | China Mobile Communications | 87,544 | 11,703 | 13.37 |

| 28 | Citigroup | 102,939 | 11,067 | 10.75 |

| 29 | Nestle | 94,405 | 10,692 | 11.33 |

| 30 | Lukoil | 111,433 | 10,357 | 9.29 |

| 31 | Berkshire Hathaway | 143,688 | 10,254 | 7.14 |

| 32 | ENI | 153,676 | 9,539 | 6.21 |

| 33 | Sinopec Group | 375,214 | 9,453 | 2.52 |

| 34 | General Motors | 150,276 | 9,190 | 6.12 |

| 35 | BASF | 102,194 | 8,604 | 8.42 |

| 36 | Siemens | 113,349 | 8,562 | 7.55 |

| 37 | BNP Paribas | 127,460 | 8,412 | 6.60 |

| 38 | Daimler | 148,139 | 7,880 | 5.32 |

| 39 | Banco do Brasil | 81,887 | 7,577 | 9.25 |

| 40 | Telefonica | 87,372 | 7,513 | 8.60 |

| 41 | Banco Santander | 117,408 | 7,440 | 6.34 |

| 42 | Hewlett-Packard | 127,245 | 7,074 | 5.56 |

| 43 | BMW | 95,692 | 6,787 | 7.09 |

| 44 | ING Group | 150,571 | 6,591 | 4.38 |

| 45 | AXA | 142,712 | 6,012 | 4.21 |

| 46 | Japan Post Holdings | 211,019 | 5,939 | 2.81 |

| 47 | Nippon Telegraph & Telephone | 133,077 | 5,924 | 4.45 |

| 48 | Enel | 110,560 | 5,768 | 5.22 |

| 49 | State Grid | 259,142 | 5,678 | 2.19 |

| 50 | GDF Suez | 126,077 | 5,566 | 4.41 |

| 51 | UnitedHealth Group | 101,862 | 5,142 | 5.05 |

| 52 | Tesco | 103,839 | 4,484 | 4.32 |

| 53 | Hitachi | 122,419 | 4,397 | 3.59 |

| 54 | Nissan Motor | 119,166 | 4,324 | 3.63 |

| 55 | Electricite de France | 90,806 | 4,185 | 4.61 |

| 56 | Reliance Industries | 76,119 | 4,117 | 5.41 |

| 57 | Glencore International | 186,152 | 4,048 | 2.17 |

| 58 | AT&T | 126,723 | 3,944 | 3.11 |

| 59 | Toyota Motor | 235,364 | 3,591 | 1.53 |

| 60 | Allianz | 134,168 | 3,539 | 2.64 |

| 61 | CVS Caremark | 107,750 | 3,461 | 3.21 |

| 62 | PTT | 79,690 | 3,456 | 4.34 |

| 63 | Societe Generale | 98,464 | 3,316 | 3.37 |

| 64 | Repsol YPF | 81,122 | 3,049 | 3.76 |

| 65 | Nippon Life Insurance | 90,783 | 2,848 | 3.14 |

| 66 | Hon Hai Precision Industry | 117,514 | 2,777 | 2.36 |

| 67 | Honda Motor | 100,664 | 2,678 | 2.66 |

| 68 | PDVSA | 124,754 | 2,640 | 2.12 |

| 69 | Verizon Communications | 110,875 | 2,404 | 2.17 |

| 70 | ArcelorMittal | 94,444 | 2,263 | 2.40 |

| 71 | Meiji Yasuda Life Insurance | 77,463 | 2,188 | 2.82 |

| 72 | JX Holdings | 119,258 | 2,161 | 1.81 |

| 73 | Valero Energy | 125,095 | 2,090 | 1.67 |

| 74 | Archer Daniels Midland | 80,676 | 2,036 | 2.52 |

| 75 | Deutsche Post | 76,307 | 1,617 | 2.12 |

| 76 | SK Holdings | 100,394 | 1,510 | 1.50 |

| 77 | Costco Wholesale | 88,915 | 1,462 | 1.64 |

| 78 | Bank of America Corp. | 115,074 | 1,446 | 1.26 |

| 79 | McKesson | 122,734 | 1,403 | 1.14 |

| 80 | Assicurazioni Generali | 112,628 | 1,190 | 1.06 |

| 81 | China State Construction Engineering | 76,024 | 1,108 | 1.46 |

| 82 | Munich Re Group | 90,137 | 976 | 1.08 |

| 83 | Cardinal Health | 102,644 | 959 | 0.93 |

| 84 | Toshiba | 77,261 | 934 | 1.21 |

| 85 | Indian Oil | 86,016 | 882 | 1.03 |

| 86 | Metro | 92,746 | 877 | 0.95 |

| 87 | Peugeot | 83,305 | 818 | 0.98 |

| 88 | Deutsche Telekom | 81,554 | 775 | 0.95 |

| 89 | AmerisourceBergen | 80,218 | 707 | 0.88 |

| 90 | EXOR Group | 117,297 | 701 | 0.60 |

| 91 | Kroger | 90,374 | 602 | 0.67 |

| 92 | Carrefour | 121,734 | 516 | 0.42 |

| 93 | Noble Group | 80,732 | 431 | 0.53 |

| 94 | Credit Agricole | 105,156 | -2,044 | -1.94 |

| 95 | E.ON | 157,057 | -3,085 | -1.96 |

| 96 | Freddie Mac | 88,262 | -5,266 | -5.97 |

| 97 | Sony | 82,237 | -5,784 | -7.03 |

| 98 | Pemex | 125,344 | -7,358 | -5.87 |

| 99 | Panasonic | 99,373 | -9,780 | -9.84 |

| 100 | Fannie Mae | 137,451 | -16,855 | -12.26 |

이것 만으로도 부족하다 "나의 ㅇㅇ은 이렇지 않다능!"을 시전하실 분들도 있을지 모르니 또 하나 진상합니다.

매출대비 순이익 비율 기준 global 500 순위 (1~100)

| 순위 | 기업명 | 매출액 | 순이익 | 순이익/매출액 |

| 1 | Industrial & Commercial Bank of China | 109,040 | 32,214 | 29.54 |

| 2 | China Construction Bank | 89,648 | 26,181 | 29.20 |

| 3 | Gazprom | 157,831 | 44,460 | 28.17 |

| 4 | Apple | 108,249 | 25,922 | 23.95 |

| 5 | Bank of China | 80,230 | 19,208 | 23.94 |

| 6 | Petronas | 97,355 | 21,915 | 22.51 |

| 7 | Agricultural Bank of China | 84,803 | 18,860 | 22.24 |

| 8 | Wells Fargo | 87,597 | 15,869 | 18.12 |

| 9 | J.P. Morgan Chase & Co. | 110,838 | 18,976 | 17.12 |

| 10 | HSBC Holdings | 110,141 | 16,797 | 15.25 |

| 11 | Ford Motor | 136,264 | 20,213 | 14.83 |

| 12 | International Business Machines | 106,916 | 15,855 | 14.83 |

| 13 | Procter & Gamble | 82,559 | 11,797 | 14.29 |

| 14 | Petrobras | 145,915 | 20,121 | 13.79 |

| 15 | China Mobile Communications | 87,544 | 11,703 | 13.37 |

| 16 | Statoil | 119,561 | 14,055 | 11.76 |

| 17 | Nestle | 94,405 | 10,692 | 11.33 |

| 18 | Chevron | 245,621 | 26,895 | 10.95 |

| 19 | Citigroup | 102,939 | 11,067 | 10.75 |

| 20 | Volkswagen | 221,551 | 21,426 | 9.67 |

| 21 | General Electric | 147,616 | 14,151 | 9.59 |

| 22 | Lukoil | 111,433 | 10,357 | 9.29 |

| 23 | Banco do Brasil | 81,887 | 7,577 | 9.25 |

| 24 | Exxon Mobil | 452,926 | 41,060 | 9.07 |

| 25 | Telefonica | 87,372 | 7,513 | 8.60 |

| 26 | BASF | 102,194 | 8,604 | 8.42 |

| 27 | Samsung Electronics | 148,944 | 12,059 | 8.10 |

| 28 | Siemens | 113,349 | 8,562 | 7.55 |

| 29 | Total | 231,580 | 17,069 | 7.37 |

| 30 | Berkshire Hathaway | 143,688 | 10,254 | 7.14 |

| 31 | BMW | 95,692 | 6,787 | 7.09 |

| 32 | BP | 386,463 | 25,700 | 6.65 |

| 33 | BNP Paribas | 127,460 | 8,412 | 6.60 |

| 34 | Royal Dutch Shell | 484,489 | 30,918 | 6.38 |

| 35 | Banco Santander | 117,408 | 7,440 | 6.34 |

| 36 | ENI | 153,676 | 9,539 | 6.21 |

| 37 | General Motors | 150,276 | 9,190 | 6.12 |

| 38 | Hewlett-Packard | 127,245 | 7,074 | 5.56 |

| 39 | Reliance Industries | 76,119 | 4,117 | 5.41 |

| 40 | Daimler | 148,139 | 7,880 | 5.32 |

| 41 | ConocoPhillips | 237,272 | 12,436 | 5.24 |

| 42 | Enel | 110,560 | 5,768 | 5.22 |

| 43 | UnitedHealth Group | 101,862 | 5,142 | 5.05 |

| 44 | China National Petroleum | 352,338 | 16,317 | 4.63 |

| 45 | Electricite de France | 90,806 | 4,185 | 4.61 |

| 46 | Nippon Telegraph & Telephone | 133,077 | 5,924 | 4.45 |

| 47 | GDF Suez | 126,077 | 5,566 | 4.41 |

| 48 | ING Group | 150,571 | 6,591 | 4.38 |

| 49 | PTT | 79,690 | 3,456 | 4.34 |

| 50 | Tesco | 103,839 | 4,484 | 4.32 |

| 51 | AXA | 142,712 | 6,012 | 4.21 |

| 52 | Repsol YPF | 81,122 | 3,049 | 3.76 |

| 53 | Nissan Motor | 119,166 | 4,324 | 3.63 |

| 54 | Hitachi | 122,419 | 4,397 | 3.59 |

| 55 | Wal-Mart Stores | 446,950 | 15,699 | 3.51 |

| 56 | Societe Generale | 98,464 | 3,316 | 3.37 |

| 57 | CVS Caremark | 107,750 | 3,461 | 3.21 |

| 58 | Nippon Life Insurance | 90,783 | 2,848 | 3.14 |

| 59 | AT&T | 126,723 | 3,944 | 3.11 |

| 60 | Meiji Yasuda Life Insurance | 77,463 | 2,188 | 2.82 |

| 61 | Japan Post Holdings | 211,019 | 5,939 | 2.81 |

| 62 | Honda Motor | 100,664 | 2,678 | 2.66 |

| 63 | Allianz | 134,168 | 3,539 | 2.64 |

| 64 | Archer Daniels Midland | 80,676 | 2,036 | 2.52 |

| 65 | Sinopec Group | 375,214 | 9,453 | 2.52 |

| 66 | ArcelorMittal | 94,444 | 2,263 | 2.40 |

| 67 | Hon Hai Precision Industry | 117,514 | 2,777 | 2.36 |

| 68 | State Grid | 259,142 | 5,678 | 2.19 |

| 69 | Glencore International | 186,152 | 4,048 | 2.17 |

| 70 | Verizon Communications | 110,875 | 2,404 | 2.17 |

| 71 | Deutsche Post | 76,307 | 1,617 | 2.12 |

| 72 | PDVSA | 124,754 | 2,640 | 2.12 |

| 73 | JX Holdings | 119,258 | 2,161 | 1.81 |

| 74 | Valero Energy | 125,095 | 2,090 | 1.67 |

| 75 | Costco Wholesale | 88,915 | 1,462 | 1.64 |

| 76 | Toyota Motor | 235,364 | 3,591 | 1.53 |

| 77 | SK Holdings | 100,394 | 1,510 | 1.50 |

| 78 | China State Construction Engineering | 76,024 | 1,108 | 1.46 |

| 79 | Bank of America Corp. | 115,074 | 1,446 | 1.26 |

| 80 | Toshiba | 77,261 | 934 | 1.21 |

| 81 | McKesson | 122,734 | 1,403 | 1.14 |

| 82 | Munich Re Group | 90,137 | 976 | 1.08 |

| 83 | Assicurazioni Generali | 112,628 | 1,190 | 1.06 |

| 84 | Indian Oil | 86,016 | 882 | 1.03 |

| 85 | Peugeot | 83,305 | 818 | 0.98 |

| 86 | Deutsche Telekom | 81,554 | 775 | 0.95 |

| 87 | Metro | 92,746 | 877 | 0.95 |

| 88 | Cardinal Health | 102,644 | 959 | 0.93 |

| 89 | AmerisourceBergen | 80,218 | 707 | 0.88 |

| 90 | Kroger | 90,374 | 602 | 0.67 |

| 91 | EXOR Group | 117,297 | 701 | 0.60 |

| 92 | Noble Group | 80,732 | 431 | 0.53 |

| 93 | Carrefour | 121,734 | 516 | 0.42 |

| 94 | Credit Agricole | 105,156 | -2,044 | -1.94 |

| 95 | E.ON | 157,057 | -3,085 | -1.96 |

| 96 | Pemex | 125,344 | -7,358 | -5.87 |

| 97 | Freddie Mac | 88,262 | -5,266 | -5.97 |

| 98 | Sony | 82,237 | -5,784 | -7.03 |

| 99 | Panasonic | 99,373 | -9,780 | -9.84 |

| 100 | Fannie Mae | 137,451 | -16,855 | -12.26 |

귀찮은 분들을 위한 요약본

재미있게 구경할 수 있는 싸움(무의미한 에너지의 낭비)을 부탁드려요~~~

애플이 아무리 순이익이 많고 높아도 1위는 힘들어요.

원체 덩치가 크신 석유업체들 때문에 절대액에서 지고, 금융회사들 덕분에 비율에서 집니다.

태그 : global 500,

강태공의 마음은 이런것이겠지..,

글로벌 500,

떡밥,

세계 500대 기업,

세계 기업 순위,

월척이 낚이길....,

포천,

포천지,

포춘,

포춘지

trackback :: http://engagestory.com/trackback/605

-

사실과 ì§„ì‹¤ì˜ ì°¨ì´ :: í¬ì²œì˜ 글로벌 500대 기업 순위 :: Archie Santell

I found a great...

-

사실과 ì§„ì‹¤ì˜ ì°¨ì´ :: í¬ì²œì˜ 글로벌 500대 기업 순위 :: Cedrick Schaaf

I found a great...

애플 매출대비 순이익 대단한데요...